Adjustments To Net Income | So, we need to figure out what the expenses were for the period you are interested in. Bill's net income is £105,000 (£115,000 less £10,000). Net income, also known as net profit or net earnings, is the amount of revenue left over after deducting total expenses. The amt is an alternate method of increasing adjustments to income can also decrease other taxes because some surtaxes are calculated based on agis. If the company makes no adjustment to comprehensive income, the $400 gain is double counted.

Total assets $56,000 total liabilities $32,000 net income $ 7. Accounting accounting adjustments to net income—indirect method ya wen corporation's accumulated depreciation—equipment account increased by $8,750, while $3,250 of patent amortization was recognized between balance sheet dates. Before reporting the company's final balance sheet and net income or loss. Similarly, a creditor will look to net income as a way to determine whether the company is healthy and able to use its net income to pay back its debts. The retained earnings account carries the undistributed profits of your business.

Adjustments to net income in calculating operating cash flows include which of the following accounts results in adjustments to net income under the indirect method of preparing the statement of cash flows if their balances change during the year? For example, uber technologies inc. In such cases, adjustments need to true exceptional and extraordinary items should be stripped out. Total assets $56,000 total liabilities $32,000 net income $ 7. Added to net income ( increase in note payables to be added). Please refer to the legislative extenders lesson in this publication for adjustments to income. Similarly, a creditor will look to net income as a way to determine whether the company is healthy and able to use its net income to pay back its debts. In exhibit 3, page 49, however, abc includes in its statement of income and. These were no purchases or sales of. Before reporting the company's final balance sheet and net income or loss. What's the difference between net income and operating cash flow? Adjustment to net income simply refers to making various adjustments to the net income obtained from the income statement of a company for the purpose of acquisition or purchase. In reconciling net income to changes in net cash, several adjustments are needed to reflect items that are used in calculating net income but don't have an impact on cash levels.

Added to net income ( increase in note payables to be added). While primary revenue can be assumed to remain stable as. Please refer to the legislative extenders lesson in this publication for adjustments to income. Make all cash flow adjustments to net income; Before reporting the company's final balance sheet and net income or loss.

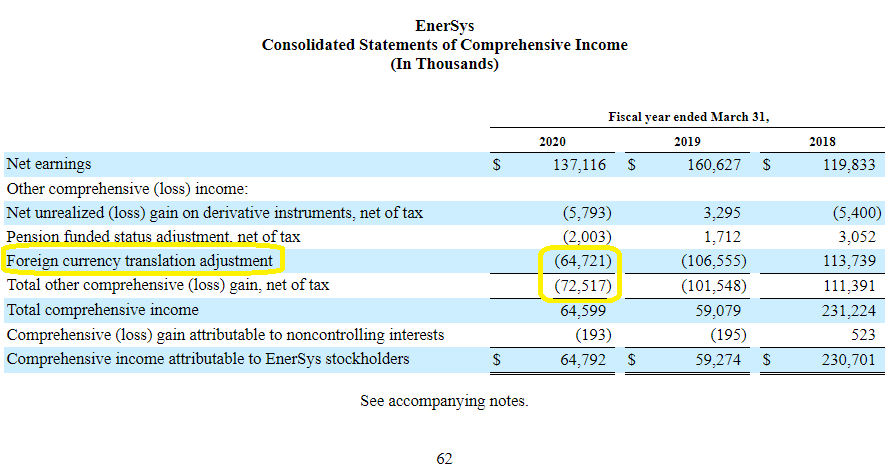

In such cases, adjustments need to true exceptional and extraordinary items should be stripped out. Similarly, a creditor will look to net income as a way to determine whether the company is healthy and able to use its net income to pay back its debts. Total assets $56,000 total liabilities $32,000 net income $ 7. For example, uber technologies inc. If the current owners have neglected the upkeep of company assets. In reconciling net income to changes in net cash, several adjustments are needed to reflect items that are used in calculating net income but don't have an impact on cash levels. Bill's net income is £105,000 (£115,000 less £10,000). Since net income is a component of comprehensive income, items included in both must be adjusted to avoid double counting. The sum of adjustments which are added to or deducted from net income or loss, including the portion attributable to noncontrolling interest, to reflect cash provided by or used in operating activities, in accordance with the indirect cash flow method. Adjusted net income or adjusted net cash flow, is used to represent the earnings of a business after expenses. Understand the difference between net income and adjusted net income, including which items factor into the adjustment and how this metric is used. A target company or comparable often faces special situations. What's the difference between net income and operating cash flow?

Adjustments to income can reduce the amount of tax owe. Featured here, the income statement (earnings report) for telus international, showing the company's financial performance from operating and non operating activities such as revenue total adjustments to net income. Added to net income ( increase in note payables to be added). These were no purchases or sales of. Adjusted net income is the reported profit or loss of a business, modified by a potential acquirer to arrive at there are a number of possible adjustments to net income, which include the following:

The sum of adjustments which are added to or deducted from net income or loss, including the portion attributable to noncontrolling interest, to reflect cash provided by or used in operating activities, in accordance with the indirect cash flow method. Adjustment to net income simply refers to making various adjustments to the net income obtained from the income statement of a company for the purpose of acquisition or purchase. Adjustments to income can reduce the amount of tax owe. So, we need to figure out what the expenses were for the period you are interested in. Make all cash flow adjustments to net income; Accounting accounting adjustments to net income—indirect method ya wen corporation's accumulated depreciation—equipment account increased by $8,750, while $3,250 of patent amortization was recognized between balance sheet dates. There are no further adjustments to bill's net income, so this is his adjusted net income. Understand the difference between net income and adjusted net income, including which items factor into the adjustment and how this metric is used. Is the $4415 your total net income during the year after adjustments and the standard deduction was applied. Added to net income ( increase in note payables to be added). Retained earnings fluctuate with changes in your income, dividends or adjustments to the previous period's accounts. Adjusted net income is an indicator of how much a business would be worth to new owners. If the company makes no adjustment to comprehensive income, the $400 gain is double counted.

Adjustments To Net Income: So can any jury duty pay an employee remits to her employer, which she might do if she continues earning regular income while serving on.

Source: Adjustments To Net Income